DRASTICALLY MINIMIZE TAXES

SUBSTANTIALLY LOWER RISK

ACHIEVE MAXIMUM RESULTS

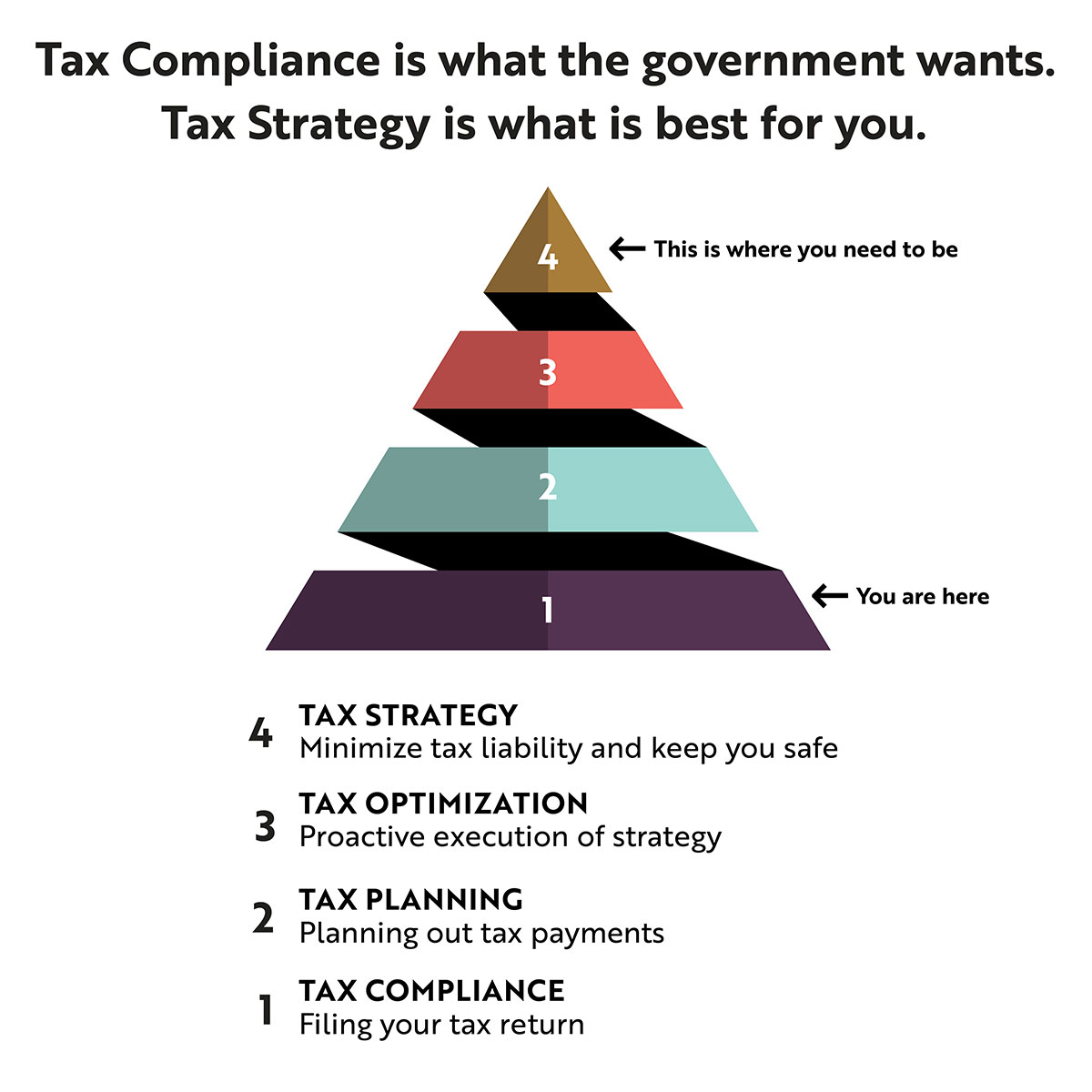

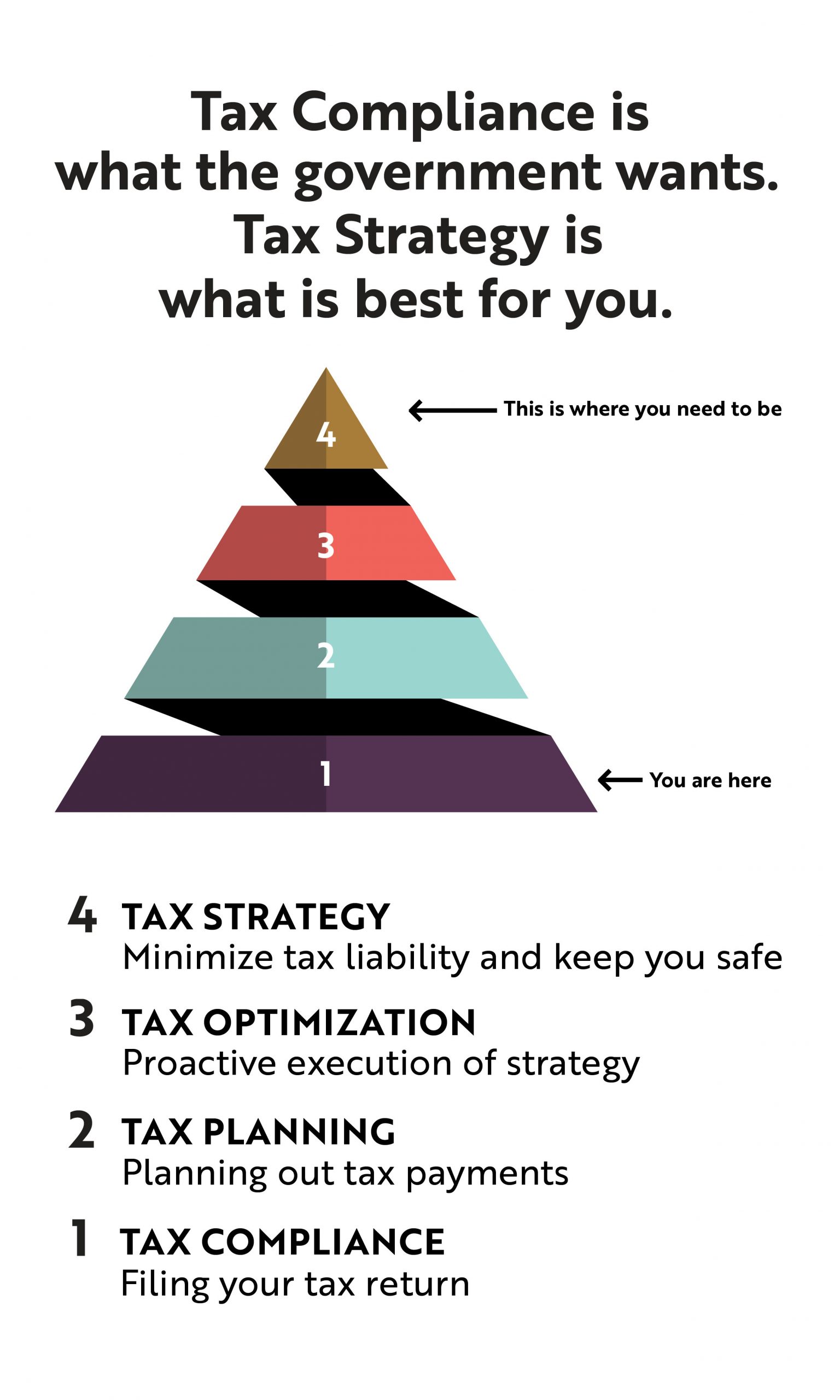

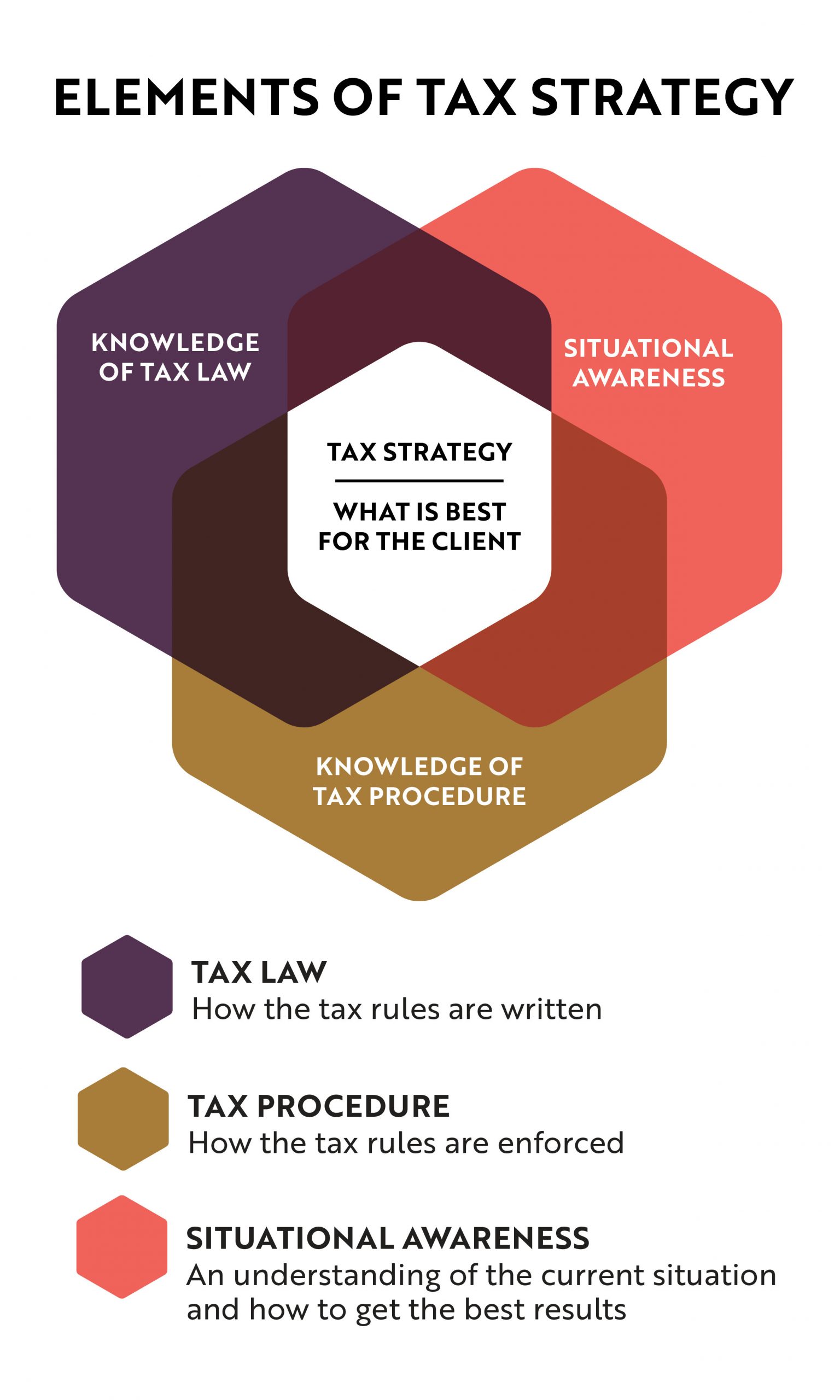

Compliance Vs. Strategy

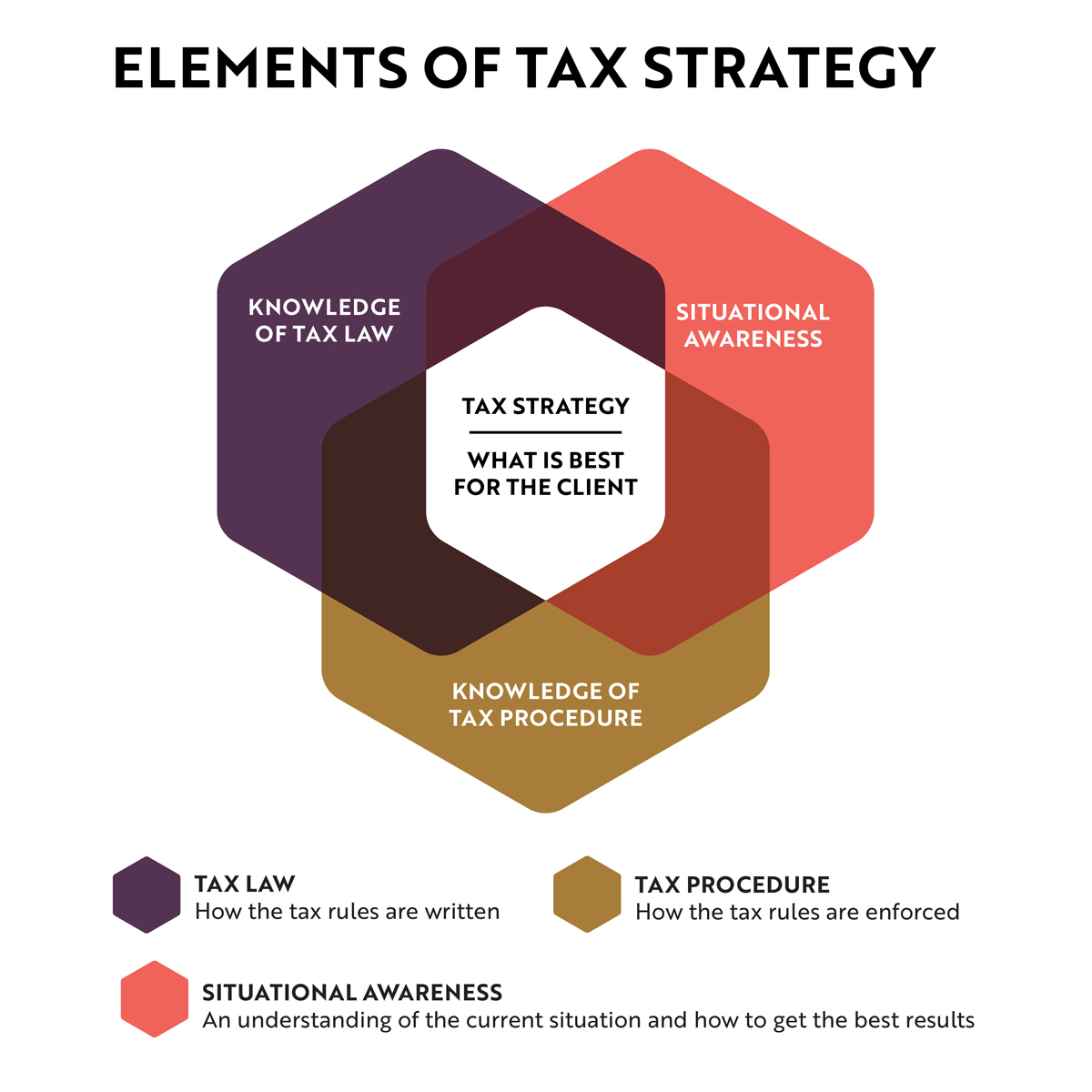

Elements of Tax Strategy

Our Thought Leadership Has Appeared In

No Matter How Complex

We Can Help You Immediately Resolve Any Tax Problem

Our Clients Will Tell You: We Get Results.

Tax Strategies, Case Studies, and Thought Leadership

Guides

The Ultimate Guide to Innocent Spouse Relief, Divorce, and Taxes

Navigating both divorce and the tax consequences it presents adds to the stress of a difficult situation. From how to file your taxes to spousal relief eligibility to alimony taxes, this guide will help you move through this stressful time.

Read More

Hundreds of $1,000,000s

Saved in Tax Penalties

100+

Appeal Victories

$1B+

Saved in Taxes

150+

Multimillion and billion-dollar corporate transactions

11+

Tax Services

400+

Clients represented in an audit

$160M+

in ERC Tax Credits

Push Play

Book a Free 15-Minute Assessment Call

Set up a quick call with our firm’s concierge to see if we’ll be able to help you. The whole process will take 15 minutes or less.